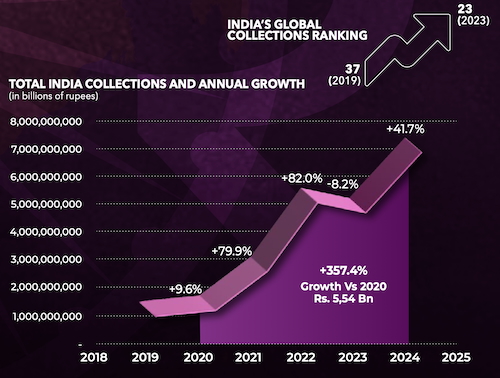

MUMBAI: India’s music scene is singing a very different tune these days—one that sounds suspiciously like cash registers ringing. Music royalty collections in India have struck a crescendo at Rs 700 crore in 2024, surging 42 per cent year-on-year and quadrupling over five years in a performance that would make even Indian cinema proud.

The star of this financial symphony? Streaming platforms, which have transformed from industry pariahs into the golden goose laying digital eggs. India's global ranking for creators' collections has leapt from a modest thirty seventh position in 2019 to twenty third in 2023, according to the International Confederation of Societies of Authors and Composers (CISAC) in its latest annual report. But before the champagne corks start popping in recording studios across the subcontinent, there's a sobering reality check. Despite the impressive crescendo, India's royalty collections remain woefully below potential for a market of this magnitude—a case of having the orchestra but missing half the instruments.

But before the champagne corks start popping in recording studios across the subcontinent, there's a sobering reality check. Despite the impressive crescendo, India's royalty collections remain woefully below potential for a market of this magnitude—a case of having the orchestra but missing half the instruments.

The culprit? Indians' stubborn reluctance to pay for premium music streaming services. While platforms like Spotify, JioSaavn and Gaana are desperately trying to wean users off their freebie addiction with subscription models—backed by music labels like Saregama—the conversion rate remains sluggish.

Adding to creators' woes is the dismal performance of non-digital revenue streams, which continue to hit bum notes. CISAC has been working overtime with the Indian Performing Rights Society (IPRS) to bring global standards to governance, licensing and royalty distribution—essentially teaching old dogs new digital tricks.

The organisations have crafted a fresh action plan for FY25, designed to explore untapped market potential and identify business opportunities. The blueprint targets improved collections from local digital services whilst diversifying revenue streams beyond the usual suspects.

With India's creative economy finally finding its rhythm, the question isn't whether the music will stop—it's how loud the next movement will be.

Follow Us

Follow Us